ad valorem property tax florida

The Tax Collector also collects non-ad valorem assessments. Lets look at the 2015 Ad Valorem taxes in detail.

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

The tax year runs from January 1st to December 31st.

. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. 2 if paid in January. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Ad Get In-Depth Property Tax Data In Minutes. According to Florida Statute 197122 all property owners have the responsibility to know the amount of tax.

The most common ad valorem taxes are. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. The following early payment discounts are available to Orange County taxpayers.

Often called property taxes Non-ad valorem Assessments. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Taxable Home Value of 75000 1000 75.

The full amount of taxes owed is due by March 31. Taxes usually increase along with the assessments subject to certain exemptions. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements.

There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. 4 discount if paid in November. The most common ad valorem taxes are property taxes levied on real estate.

Ad Valorem taxes on real property are collected by the Tax Collector on an annual basis beginning on November 1st for the calendar year January through December. Ad valorem ie according to value taxes are. 3 Oversee property tax administration.

The Tax Collector collects all ad valorem taxes levied in Polk County. Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day. Taxes are normally payable beginning November 1 of that year.

11 Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows. In Florida property taxes and real estate taxes are also known as ad valorem taxes. Based on the assessed value of property.

Our attorneys have a wealth of knowledge and experience in all aspects of property tax law and appeals to help. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now.

Property Tax bills are mailed to property owners by November 1 of each year. The greater the value the higher the assessment. If the taxable value of your home is 75000 and your citys millage rate is 72 mills then the taxes due would be calculated as follows.

Ad valorem taxes or real property taxes are based on the value of such property and are paid in arrears. These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment. The actual amount of the taxes is 477965.

Start Your Homeowner Search Today. 3 Oversee property tax administration. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice.

Floridas ad valorem statute allows tax exempt entities to be exempt from real property taxes when the property they own is being used to provide affordable rental housing as affordable housing is a charitable use. 4 if paid in November. 75 x 72 mills 540.

10 Mill means one onethousandth of a - United States dollar. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other levying bodies set the millage rates.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Real property taxes can be deductible even if not ad valorem if they provide a general community benefit and not a property-specific or local benefit. Florida Ad Valorem Valuation and Tax Data Book.

The Property Appraiser establishes the taxable value of real estate property. Body authorized by law to impose ad valorem taxes. The sovereign right of local governments to raise public money.

Uniform throughout the jurisdiction. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied. Such As Deeds Liens Property Tax More.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. A lien against property. Property ad valorem taxesie.

Property tax can be one of the biggest single expense items for commercial properties. Search Valuable Data On A Property. The taxes are assessed on a calendar year from Jan through Dec 365 days.

Santa Rosa County property taxes provide the fund local governments to provide needed services such as education law. Ad valorem means based on value. 1 The Board of County Commissioners or.

Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. Secondly what is specific tax and ad. Property taxesare usually levied by local jurisdictions such as counties or school districts.

It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received. For example a 50 charge per house for community ambulance service is a deductible property tax while 50 for streetlights that is only charged on streets with street lights is a property. 3 if paid in December.

Millage may apply to a single levy of taxes or to the cumulative of all levies. Section 1961995 Florida Statutes requires that a referendum be held if. There are three ways to pay your property taxes online with Paperless in person or by mail.

On the tax roll.

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Broward County Property Taxes What You May Not Know

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law

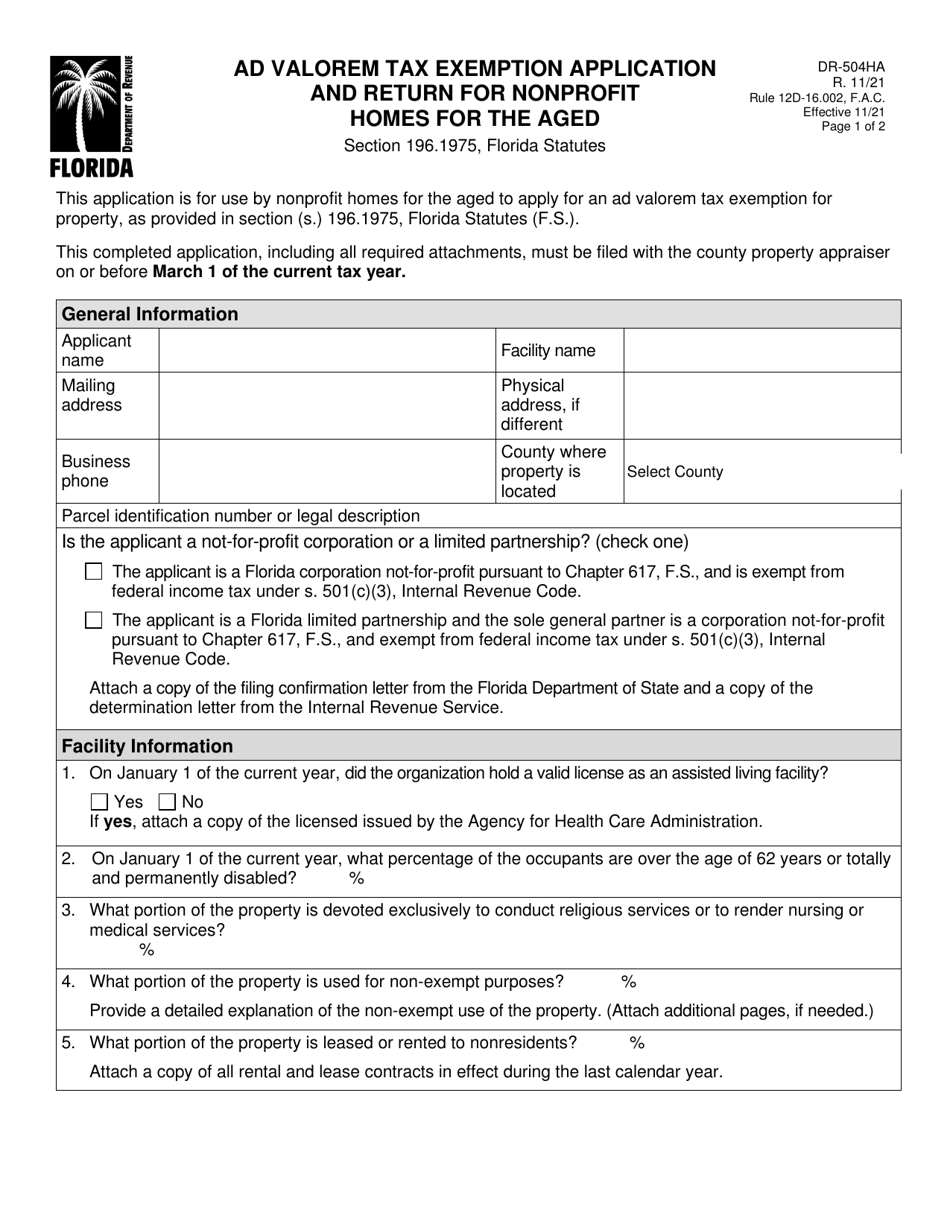

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged 2021 Templateroller

An Investment In Knowledge Always Pays The Best Interest Floridatitlecompany Realestateattorney Www Marinatitle Com Investing Estate Lawyer Real Estate

Time Is Running Out To Pay Your Property Taxes No Worries Stop By Avb Bank S Downtown Broken Arrow Location 322 S Main St Thi County Property Tax Bank

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

A Guide To Your Property Tax Bill Alachua County Tax Collector

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Real Estate Property Tax Constitutional Tax Collector

Real Estate Taxes City Of Palm Coast Florida

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

Understanding Your Tax Bill Seminole County Tax Collector

Tax Prorations Explained For Florida Real Estate Closings Part 2